5 Easy Tips to Simplify Your Charitable Giving

Will you be donating to charities this year? The Internal Revenue Service (IRS) reminds us that you must itemize deductions on Schedule A of your tax return to claim a deduction for charitable gifts. The following five tips can also help ensure that your charitable gifts count.

Your Divorce Decree: The First Step in Estate Planning

You and your spouse have recently divorced, and the judge has signed the divorce decree. Now what? Although you may feel that you have spent enough time and money on lawyers, there is one last attorney you need to talk to: an estate planning attorney.

5 Reasons Uncle Bill May Not Make a Good Trustee

If you have created a trust that you intend to last for decades, choosing the right trustee is critical to ensuring the trust’s longevity and ultimate success. Here are some reasons you may want to consider choosing a professional or corporate trustee for your trust instead of a family member.

Ways to Keep a Loved One’s Memory Alive After They Pass

There are many ways to turn memories into mementos and honor a beloved friend’s or family member’s passing. These tributes can also be a creative and strategic way to use estate assets. Planning ahead provides your loved ones with more flexibility in using your money and property for dedications and memorials. A well-thought-out plan can even set aside money for such purposes.

Ensure That Your Loved Ones Call the Right Doctor

This greater focus on health and wellness, however, stands in stark contrast to our lack of advance healthcare planning. While some Americans are diligently counting their steps, watching what they eat, and trying to live longer, healthier lives, many have failed to plan adequately for their future healthcare and what could happen in a medical emergency.

It’s Planning Season

Thoughtful planning must be done in every season of your life. To properly prepare for the next season in your life and the lives of your loved ones, you need a well-executed estate plan.

Have a Harmonious Family that Does Not Fight? You Still Need an Estate Plan

Have a Harmonious Family that Does Not Fight? You Still Need an Estate Plan. Once the matriarch or patriarch dies then years of pent-up resentment and hurt feelings surface, and the once-happy family is now embroiled in litigation over the head of the family’s money and property.

Where Is the Best Place to Store Your Original Estate Planning Documents?

Where Is the Best Place to Store Your Original Estate Planning Documents? Estate planning attorneys are often asked where original estate planning documents—wills, trusts, powers of attorney, and healthcare directives—should be stored for safekeeping.

Is It Time for an Annual Planning Retreat?

What Is a Planning Retreat? You might have heard of a wellness retreat—a type of getaway that offers the chance to focus on self-care, relaxation, and spiritual growth. A planning retreat is similar to a wellness retreat. Both are intended to promote time away from the stresses and distractions of everyday life.

4 Tips to Avoid a Will or Trust Contest

Fighting over provisions in your will or trust can derail your final wishes, rapidly deplete your financial legacy, and tear your loved ones apart. However, with proper planning, you can help your family avoid a potentially disastrous fight.

Should I Buy a Home with Someone Other than a Spouse?

Rising housing costs, the desire for companionship, and the need to share resources are increasingly leading buyers to consider co-owning a home with someone other than a spouse, such as a friend, relative, or significant other. Although this arrangement can be beneficial on several levels, it should be approached with open communication, careful planning, and a clear understanding of the financial and legal implications.

3 Asset Protection Tips You Can Use Now

A common misconception is that only wealthy individuals and people in high-risk professions, such as doctors or lawyers, need an asset protection plan. However, anyone can be sued. A car accident, foreclosure, unpaid medical bills, or an injured tenant can result in a monetary judgment that could crush your finances.

Who Is Part of Your Professional Team?

Lists. There is one crucial list that often gets overlooked: the list of trusted professionals and decision-makers who can step in for you during a time of need. This list can be a centralized document of all the key players in your life who advise you on a regular basis or are legally designated to carry out your affairs when you become incapacitated (unable to manage your affairs), pass away, or experience an emergency.

The Trust Protection Myth: Your Revocable Trust Protects Against Lawsuits

Many people believe that once they set up a revocable living trust and change the ownership of their accounts and property from themselves as individuals to their trust, those accounts and property are protected from lawsuits. This is not true.

Important Legacy Questions You Should Answer in Your Estate Plan

Aside from your money and property, are there other things you want to leave your loved ones? Any inspiring words or values that you hope they heed?

Estate Planning That Expresses Who You Are 5 Things to Talk About with Your Family

You intend to pass along your hard-earned money and property through your estate plan, but what about your wisdom? Bring your family into conversations, as they will get to learn new things about you and share stories and memories of their own.

Who Needs as Estate Plan?

Who Needs an Estate Plan? If you are reading this, you need an estate plan. Why? The short answer is that everyone age 18 and older needs an estate plan.

Why Joint Ownership Should Not Be the Go-To Plan for Newlyweds

If you recently married or have been married for a while and have acquired additional money or property (or plan to), you have options regarding how your assets can be owned. Although joint ownership seems easy and convenient, it may not always work as well as you think it should, depending on the circumstances.

Your Post-Honeymoon Legal Checklist

What to Do After the Honeymoon. As you start living happily ever after, make sure to take care of these post-honeymoon to-dos during the first few weeks (or even days) after your wedding. This will help give you peace of mind so you can enjoy the memories of your wedding and honeymoon for years to come. The following checklist can serve as a reminder of some of the tasks to which you should give your immediate attention:

The Estate of Richard Simmons: Sweatin’ the Small Stuff

Richard Simmons death and estate issues. Because of a legal dispute between his longtime housekeeper, Teresa Reveles Muro, and his brother, Leonard (Lenny) Simmons, the estate of the Sweatin’ to the Oldies star is now sweating out a legal dispute over control of Richard’s trust.

Estate Planning for the Newly Married

As newlyweds, you are likely in the process of deciding which of your accounts and property (your assets) to combine and how to turn two households into one. You may also be setting up new bank accounts and creating a plan for paying shared bills and other expenses. Learn some critial estate planning for newlyweds.

Estate Planning Basics for Newlyweds: How to Prepare for the Unexpected

Getting married is a special time in your life. It is also the right time for you and your new spouse to plan for your future—for richer or for poorer, in sickness and in health. Here are some estate planning basics for newlyweds.

First Step in Adulthood: Choosing the Right Decision-Makers

Being an adult comes with freedom and responsibility. You can now make important decisions on your own without consulting your parents or guardians. You need to legally appoint decision-makers for your medical, legal, and financial matters.

Wills, Trusts, and Dying Intestate: How They Differ

Most people understand that having an estate plan benefits them and their loved ones. However, many individuals do not initiate the estate planning process because they do not fully understand the nuances of foundational estate planning tools such as a will and a...

Happy 18th Birthday! Now What?

When you were a minor (under age 18), your parents were your legal guardians responsible for making all your decisions. Now that you are an adult, their legal authority over you is limited, if not completely nonexistent. While this newfound freedom may sound exciting, there are legal matters you should consider.

Four Steps to Stop Mail Addressed to a Deceased Person

Steps to Stop Mail Addressed to a Deceased Person. If you are handling their estate what should you do?

Who Should Be Your Successor Trustee?

If you have a revocable living trust, you probably named yourself as the initial trustee so that you can continue to manage your financial affairs. However, someone else will eventually need to step in to administer your trust when you are no longer able to act due to incapacity (the inability to manage your affairs) or after your death. This person is known as your successor trustee.

How to Choose the Initial Trustee of Your Trust

How to Choose the Initial Trustee of Your Trust. When you establish a trust, you nominate someone to be the trustee. If you are creating a revocable living trust, you will likely be the initial trustee.

How a Beneficiary Designation Works?

Do you know how a beneficiary designation works?

How to Choose a Conservator for Yourself

Every day we make hundreds of decisions for ourselves—from what to eat for breakfast to where to vacation. However, what happens if you cannot make decisions for yourself? Who do you want making day-to-day decisions on your behalf and serving as your conservator?

How Do You Define the Beneficiaries of Your Trust?

Who are your descendants?

In the past, the definition of descendant was straightforward: a person who can be traced back to a specific ancestor through the same bloodlines. But planning for today’s more diverse family structures now encompasses much more than biological heirs.

What to Do with Grandma’s Ring: Dividing Personal Property in an Estate

The little things in life can sometimes have sentimental value as well as financial value. For these reasons, personal items of the deceased can often create controversy when it is time to divide up belongings and there is no clear plan for who gets what.

Why Can’t I Just Prepare My Own Estate Plan?

Can’t I just do my own estate plan? You may think creating a simple estate plan should be easy and something you can do independently. Unfortunately, this is not the case. Estate planning laws vary greatly from state to state, can sometimes be complicated, and constantly change.

Do Not Become a Statistic

Whether you need to create an estate plan or update an existing one, do not put it off. The following are some scary statistics about the average American and estate plans.

How to Make Your Inheritance Last

Most people believe that receiving a large inheritance from a loved one would be life-changing. At least one study, however, found that about one-third of Americans who had received an inheritance eventually experienced a decrease or no change in their wealth after receiving the inheritance, meaning that they most likely spent everything they received. Here are steps to ensure your funds will last longer.

3 Tips for Every New Homeowner

Whether this is your first home or you are upgrading or downsizing from your current home, the purchase of a home is a big event in your life. When major life events occur, it is important that you have a plan in place to ensure that you are properly prepared for the future. Here we will discuss some things to consider.

Emergency Pet Planning Every Pet Owner Should Have In Place.

Best Friends Animal Society, a nonprofit animal welfare organization, recommends that owners arrange to have emergency and permanent caretakers for their pet.

Top 3 Reasons You Need an Up-to-Date Estate Plan

Education on the importance of an estate plan is key to saving the time, money, and heartache that can be associated with lack of planning. Take the time to understand the importance of having an up-to-date estate plan and learn how it not only contemplates what happens after your death, but also protects you and your loved ones if you become incapacitated.

Can Someone Else Pay for My Estate Plan?

Having somebody else pay for your estate plan can help with cost-related concerns. In most cases, it is perfectly fine for another person to do so. But as great as the gift of estate planning is, attorneys have certain ethical and professional obligations to their client

The Residuary Estate

The Residuary Estate. In estate planning, residue has a special meaning, referring to the portion of a deceased person’s assets that remain after all debts and taxes have been paid and gifts have been made to beneficiaries.

Not All Conditions for Beneficaries Will Hold Up In Court

Although parents can be highly creative and detailed in structuring conditional gifts in their estate plan, their freedom to impose conditional gift terms is limited.

What Conditions Can I Put on My Child’s Inheritance?

You have two primary options for leaving an inheritance to a child. Estate planning lets you control from beyond the grave who receives your money, when they receive it, and how they may use it. This is conditional gifting.

5 Tragic Mistakes People Make When Leaving an Inheritance to Their Pets

Planning for your pets in your estate plan is an excellent way to ensure that your beloved pet will receive proper care and attention after you pass on. Here are five tragic mistakes people often make when leaving an inheritance to their pets.

Are You Ready to Move Away from Home?

Are You Ready to Move Away from Home? With greater independence comes more responsibility. Your family may see you off with some parting advice about how to navigate the trials of adulting. One thing they might not have mentioned is the importance of having your legal house in order as you start this new life chapter. This includes having an up-to-date estate plan.

Setting Up a Trust for an Addicted Loved One

What can happen if you fail to plan in your estate plan for an addicted loved one? Consider setting up a trust for them.

Estate Planning for Beneficiaries with Substance Abuse Issues

There is not a one-size-fits-all solution for assisting a loved one who is dealing with substance abuse. When considering including an addicted loved one in an estate plan, it is useful to remember that estate planning can be uniquely tailored to the needs of each family and individual

Five Wishes Booklet

Five Wishes booklet, what it does and how it can help you.

What is a Conservator?

What is a Conservator, and what do they do?

What is the Difference Between a Personal Representative, an Executor, and an Administrator?

What is the difference between a Personal Representative, an Executor, and an Administrator of an Estate?

Can You Purchase a Home from a Trust, as a Beneficiary, if There are Other Beneficiaries?

Can You Purchase a Home from a Trust, as a Beneficiary, if There are Other Beneficiaries?

What Can I Not Do as Trustmaker and Trustee of a Revocable Living Trust?

Before setting up a revocable living trust, you should understand what you can—and cannot—do in your dual role as trustmaker and trustee. Living trusts are complex legal documents that need to be drafted carefully with help from an estate planning attorney.

What Happens to An Adult Child Living at Home When Their Parents Pass Away?

Today more young adults are living at home with their parents than at any time since the 1940s. Most adult children who still live at home have future plans to move out at some point. However, if one or both of their parents pass away prior to that time without addressing the adult child’s living situation in their estate plan, it can present legal issues.

What is a 529 Plan?

What is a 529 Plan? What happens if there are unused funds?

Aretha Franklin: Too Much Estate Planning

Too little estate planning can put your heirs in a bind and tie up your estate in time-consuming and costly probate litigation. But as the legal saga of Aretha Franklin’s estate shows, too much estate planning—in particular, planning that introduces uncertainty about your final wishes—can also be problematic.

What to Do When a Disability Throws Your Estate Plan into Chaos

Once you are no longer able to manage your own affairs, you will not be able to turn back the clock and make plans that will make your transition into a possible incapacity as smooth as possible for you and your loved ones. However, you can take meaningful actions prior to an incapacity to protect your money, property, and legacy in the wake of any newfound limitations. Here’s how.

Who Will Care for Your Child When You Cannot?

In most cases, estate planning is going to help develop a plan for protecting your child in the event that neither parent is able to care for them. What happens if you die with or without an estate plan? Is the outcome the same?

If My Will Is Filed with the Court, Will It Go through Probate?

Not all wills, and not all accounts and property, need to go through probate court. And just because a will is filed with the probate court does not mean a probate needs to be opened. But whether or not probate is necessary, most state laws require that a will be filed when the creator of the will passes away.

How to Choose the Right Agents for Your Incapacity Plan

Many people believe that estate planning is only about planning for their death. But planning for what happens after you die is only one piece of the estate-planning puzzle. It is just as important to plan for what happens if you become unable to manage your own financial or medical affairs while you are alive (in other words, if you become incapacitated).

What Happens With Your Will When You Die?

If you have chosen a will as your estate planning took, what happens with that will when you die?

Beware of Nonlawyers Acting Like Lawyers

Relying on nonlawyers to help with estate planning forms or provide legal advice can pose significant risks. Many professions should not provide legal advice, but it is not uncommon for some to cross into legal territory when they have related fields of expertise. Individuals in these professions must recognize the boundaries of their expertise and refer clients to qualified legal professionals when estate planning advice is needed.

What is the Difference Between a First-Party SNT and a Third-Party SNT?

There are two main types of SNTs: first-party SNTs and third-party SNTs. Both are intended to ensure that a person with a disability or functional needs can receive financial support from the trust while preserving their government benefits. What differentiates these two types of trusts is the source of trust funding and the government’s entitlement to a portion of the trust’s funds.

How Do You Leave an Inheritance to Someone With a Disability?

Family members with special needs may require assistance throughout their lives. If you want to ensure that a loved one with a disability is taken care of after you are gone, you can help manage resources for them by using a third-party special needs trust (SNT).

Estate Administration Details that TV and Movies Get Wrong

While television and movies provide great entertainment, they are not always factual. Even shows based on real events are not entirely accurate. Creators of television programs and movies will often alter details of a story or situation to provide an enjoyable experience. Because of these widespread embellishments, people often develop misconceptions about many industries and professions, including attorneys and estate planning.

The Corporate Transparency Act

Business Owners – New law put into effect for anyone who owns an LLC or corporation – action is needed.

What Happens to Real Estate with a Mortgage When I Die?

Your mortgage, like the rest of your debt, does not simply disappear when you die. If you leave your home that has an outstanding loan to a beneficiary in your will or trust, your beneficiary will inherit not only the property but also the outstanding debt. They may have the right to take over the mortgage and keep the home, or they may choose to sell it and keep the proceeds. A few different scenarios can unfold, however, depending on the mortgage terms and the estate plan instructions.

I’m a Survivor . . . and Now I Have My Own Trust?

I’m a Survivor . . . and Now I Have My Own Trust? Many married couples share almost everything, including finances. This may be reflected in their estate plan by using one joint living trust instead of two separate trusts. Separate trusts can provide greater flexibility, but a joint trust can be structured so that when one spouse passes away, the trust is split into two subtrusts: a survivor’s trust and a decedent’s trust.

Testamentary Trusts: The Best of Both Worlds

Testamentary Trusts: The Best of Both Worlds. You have several different options when it comes to creating the right estate plan. Some people believe that a revocable living trust is the best way to go, while others think that a last will and testament (commonly known as a will) is best under certain circumstances. Others may find that a combination of both—through the use of a testamentary trust—provides the right amount of control and protection for themselves and their loved ones.

Pitfalls of Creating a DIY Will

Pitfalls of Creating a DIY Will. It may be tempting to use an online service, or do some google research, and make a will without the help of an estate planning attorney. There are important legal and financial risks you should consider before making that decision.

Do Not Leave Your Trust Unprotected: How a Trust Protector Can Help.

Trust protectors are commonly used in the United States. Essentially, a trust protector is someone who serves as an appointed authority over a trust that will be in effect for a long period of time. Trust protectors ensure that trustees maintain the integrity of the trust, make solid distribution and investment decisions, and adapt the trust to changes in law and circumstance.

Examples of When an Irrevocable Trust Can-and Should-Be Modified

Did you know that irrevocable trusts can be modified? If you did not, you are not alone. The name lends itself to that very misconception. However, the truth is that changes in laws, family, trustees, and finances can frustrate the trustmaker’s original intent when the trust was created. Or, sometimes, an error in the trust document is identified. When this happens, it is wise to consider changing the trust, even if that trust is irrevocable.

Disadvantages of Sharing Your Estate Planning Details with Loved Ones

Sharing your estate plan with your loved ones can compromise the privacy of your financial and personal information. Some people therefore prefer to keep these matters private, especially when it comes to distributions of significant amounts of money or property.

Advantages of Sharing Your Estate Planning Details With Loved Ones

When you decide to create a comprehensive estate plan, there are many things to consider. One is whether to tell your loved ones about your plan and how much information to share with them. Estate planning can be a complex and sensitive matter, so your choice may depend on your unique relationships with loved ones and your family dynamics.

What Is a Conservatorship?

What Is a Conservatorship? A conservatorship is a court-ordered arrangement that gives one person (or multiple people), called a conservator, legal authority to manage the affairs of another person, known as a conservatee or ward. Most jurisdictions—recognize two types of conservatorships.

Situations Requiring More Than a Basic Will

Situations Requiring More Than a Basic Will. While a basic online will may be a viable option for some, an experienced attorney is helpful in certain circumstances when a will is just not enough.

Errors That Make Documents Unenforceable

Errors That Make Documents Unenforceable. Estate planning attorneys help you avoid the following common mistakes in online documents that could make them unenforceable, require a court to interpret them, or lead to fighting among your loved ones.

Common Ways to Hold Ownership or Title to Real Estate.

There are different ways to take title or ownership to real estate. Attorney Longtin discusses the 3 most common and what they mean.

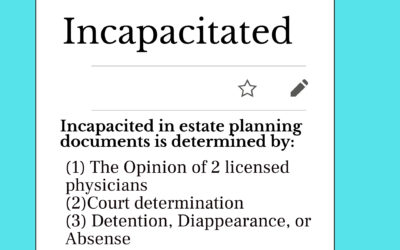

What Makes a Person by Definition Incapacitated in Estate Planning Documents

In estate documents, what is it that makes a person considered incapacitated, by definition?

The Difference Between Shall and May in Estate Planning.

Estate planning terms – small words such as shall and may can have very different meanings. It is important to ensure the correct term is used in your estate planning documents.

What is a QTIP Trust?

What is a QTIP Trust and how does it work in your estate planning?

Location of Important Documents

When one spouse is the “money person” in the relationship, it can create issues in both life and death. To avoid unnecessary stress, couples need to ensure that they are on the same page.

Impact of Enstrangement on Estate Planning

Unfortunately, rifts sometimes arise between family members that are much more serious than just temporary squabbles. The result may be estrangement, defined as “the state of being alienated or separated in feeling or affection; a state of hostility or unfriendliness” or “the state of being separated or removed.” Estrangement does not mean that the relationship has come to an end legally, however.

Bills and Services to Cancel—and Keep—When a Loved One Dies

Bills and Services to Cancel—and Keep—When a Loved One Dies. Most people subscribe to multiple digital subscription services in addition to utilities, insurance, memberships, medical prescriptions, and other recurring payment programs. Settling these accounts helps avoid unnecessary charges and protect against identity theft and fraud. If the duty to handle outstanding accounts falls to you, you will first want to identify which accounts your loved one held and then figure out what to do with them.

Why You Want to Avoid Dying Without a Will in Place?

While the reasons for not having a will vary, the end result is the same for everyone: they do not get to choose who receives their property when they die. Instead, their money and property are distributed according to the laws of their state in a process called intestate succession.

Difference Between Transfer on Death and Payable on Death Designation

Adding a payable-on-death (POD) or transfer-on-death (TOD) designation to an account allows the assets (money and property) in that account to be passed to a named beneficiary when the original account holder dies.

Do I Lose Control of My Assets in a Living Trust?

What happens with my assets in a living trust?

Have an Etsy Store? Make Sure It Is Properly Protected

Etsy sellers tend to be independent workers who seek success on their own terms. But you should have a contingency plan for your Etsy store that considers the worst-case scenario of incapacitation or death. Ask yourself: what would happen to your store if you were no longer able to run it?

Gifting Personal Items in an Estate Plan

Gaps in an estate plan can lead to conflict among surviving family members. Estate plans tend to focus on big-ticket items like houses, cars, bank accounts, and investments. But deciding who is entitled to personal momentos – especially valuable ones-can be an underestimated source of contention.

When and How Will Your Child Receive Their Inheritance?

Do you know what happens to your child’s inheritance if you do or do not have an estate plan?

What Happens If I am Alive But Cannot Communicate?

Contemplating incapacity can be as anxiety-inducing as thinking about death. There are estate planning tools that can ensure that you do not end up in legal limbo due to a mental or physical disorder that renders you unable to manage your affairs or make decisions.

Planning a Barbecue Is Like Planning Your Estate

For many, Summer signals the beginning of summer and enjoying warm-weather activities, including backyard barbecues with friends and family. Although a cookout may be an informal affair, planning is crucial to its success. This is true for estate planning, too. Just as preparations are necessary for a successful cookout, a little planning goes a long way to prevent a poorly designed estate plan (or no estate plan at all!) from leaving you and your loved ones in a pickle.

Remodeling a Home in a Trust with a Home Equity Loan

If you want to remodel your home that is a trust with an equity loan, there are some things you should know.

Will I Have to Pay a Mortgage In Full if I Inherit a Property From a Relative?

The Garn–St Germain Act is a federal law that allows lenders to enter into or enforce contracts, including mortgage agreements, that contain due-on-sale clauses even if a state’s constitution or laws, including their judicial decisions, prohibit them.

What is a Limited Liability Company?

What is and LLC? What does it do?

How to Manage Expectations if You Should Win the Lottery?

How to manage expectations if you should win the lottery.

How to Donate Used Medical Equipment

How to Donate Used Medical Equipment. There are several options and locations that will accept this type of equipment.

Working with Co-trustees: How You Can Help

When clients select a successor trustee for their trust, they frequently choose one person to serve as a successor trustee at a time. However, many clients are reluctant to place the entire responsibility for trust administration on one person. As a result, it is increasingly common for a trustmaker to nominate two or more family members or friends to serve as successor co-trustees.

Ways Your Will Can Be Revoked

But simply creating a will does not mean that your estate plan is complete or final: your will may need to be updated from time to time. It may even need to be revoked and redrafted entirely.

Usually, revoking a will is a purposeful act on the part of the will maker. But many states have laws that automatically revoke a will, or portions of it, in specific situations.

Using a Standby Supplemental Needs Trust to Protect Your Loved Ones

As helpful as it would be when planning, no one has a crystal ball to see into the future. We do not know when we will pass away, and we do not know what position a beneficiary will be in at the time of our death. So even if you do not currently have a loved one who is disabled, it is critical not to overlook the question of what will happen if your loved one becomes disabled at a future time.

Have You Chosen the Right Trustee?

Whether you are reviewing your existing trust or creating a new trust, you should understand the important role that a trustee plays not only in handling trust matters but also in providing for and protecting your loved ones.