What is the Difference Between a First-Party SNT and a Third-Party SNT?

There are two main types of SNTs: first-party SNTs and third-party SNTs. Both are intended to ensure that a person with a disability or functional needs can receive financial support from the trust while preserving their government benefits. What differentiates these two types of trusts is the source of trust funding and the government’s entitlement to a portion of the trust’s funds.

How Do You Leave an Inheritance to Someone With a Disability?

Family members with special needs may require assistance throughout their lives. If you want to ensure that a loved one with a disability is taken care of after you are gone, you can help manage resources for them by using a third-party special needs trust (SNT).

Estate Administration Details that TV and Movies Get Wrong

While television and movies provide great entertainment, they are not always factual. Even shows based on real events are not entirely accurate. Creators of television programs and movies will often alter details of a story or situation to provide an enjoyable experience. Because of these widespread embellishments, people often develop misconceptions about many industries and professions, including attorneys and estate planning.

The Corporate Transparency Act

Business Owners – New law put into effect for anyone who owns an LLC or corporation – action is needed.

What Happens to Real Estate with a Mortgage When I Die?

Your mortgage, like the rest of your debt, does not simply disappear when you die. If you leave your home that has an outstanding loan to a beneficiary in your will or trust, your beneficiary will inherit not only the property but also the outstanding debt. They may have the right to take over the mortgage and keep the home, or they may choose to sell it and keep the proceeds. A few different scenarios can unfold, however, depending on the mortgage terms and the estate plan instructions.

I’m a Survivor . . . and Now I Have My Own Trust?

I’m a Survivor . . . and Now I Have My Own Trust? Many married couples share almost everything, including finances. This may be reflected in their estate plan by using one joint living trust instead of two separate trusts. Separate trusts can provide greater flexibility, but a joint trust can be structured so that when one spouse passes away, the trust is split into two subtrusts: a survivor’s trust and a decedent’s trust.

Testamentary Trusts: The Best of Both Worlds

Testamentary Trusts: The Best of Both Worlds. You have several different options when it comes to creating the right estate plan. Some people believe that a revocable living trust is the best way to go, while others think that a last will and testament (commonly known as a will) is best under certain circumstances. Others may find that a combination of both—through the use of a testamentary trust—provides the right amount of control and protection for themselves and their loved ones.

Pitfalls of Creating a DIY Will

Pitfalls of Creating a DIY Will. It may be tempting to use an online service, or do some google research, and make a will without the help of an estate planning attorney. There are important legal and financial risks you should consider before making that decision.

Do Not Leave Your Trust Unprotected: How a Trust Protector Can Help.

Trust protectors are commonly used in the United States. Essentially, a trust protector is someone who serves as an appointed authority over a trust that will be in effect for a long period of time. Trust protectors ensure that trustees maintain the integrity of the trust, make solid distribution and investment decisions, and adapt the trust to changes in law and circumstance.

Examples of When an Irrevocable Trust Can-and Should-Be Modified

Did you know that irrevocable trusts can be modified? If you did not, you are not alone. The name lends itself to that very misconception. However, the truth is that changes in laws, family, trustees, and finances can frustrate the trustmaker’s original intent when the trust was created. Or, sometimes, an error in the trust document is identified. When this happens, it is wise to consider changing the trust, even if that trust is irrevocable.

Disadvantages of Sharing Your Estate Planning Details with Loved Ones

Sharing your estate plan with your loved ones can compromise the privacy of your financial and personal information. Some people therefore prefer to keep these matters private, especially when it comes to distributions of significant amounts of money or property.

Advantages of Sharing Your Estate Planning Details With Loved Ones

When you decide to create a comprehensive estate plan, there are many things to consider. One is whether to tell your loved ones about your plan and how much information to share with them. Estate planning can be a complex and sensitive matter, so your choice may depend on your unique relationships with loved ones and your family dynamics.

What Is a Conservatorship?

What Is a Conservatorship? A conservatorship is a court-ordered arrangement that gives one person (or multiple people), called a conservator, legal authority to manage the affairs of another person, known as a conservatee or ward. Most jurisdictions—recognize two types of conservatorships.

Situations Requiring More Than a Basic Will

Situations Requiring More Than a Basic Will. While a basic online will may be a viable option for some, an experienced attorney is helpful in certain circumstances when a will is just not enough.

Errors That Make Documents Unenforceable

Errors That Make Documents Unenforceable. Estate planning attorneys help you avoid the following common mistakes in online documents that could make them unenforceable, require a court to interpret them, or lead to fighting among your loved ones.

Common Ways to Hold Ownership or Title to Real Estate.

There are different ways to take title or ownership to real estate. Attorney Longtin discusses the 3 most common and what they mean.

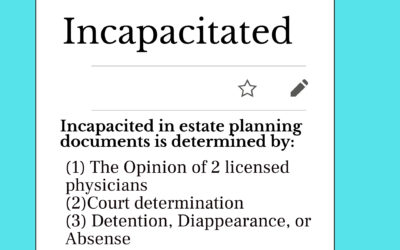

What Makes a Person by Definition Incapacitated in Estate Planning Documents

In estate documents, what is it that makes a person considered incapacitated, by definition?

The Difference Between Shall and May in Estate Planning.

Estate planning terms – small words such as shall and may can have very different meanings. It is important to ensure the correct term is used in your estate planning documents.

What is a QTIP Trust?

What is a QTIP Trust and how does it work in your estate planning?

Location of Important Documents

When one spouse is the “money person” in the relationship, it can create issues in both life and death. To avoid unnecessary stress, couples need to ensure that they are on the same page.

Impact of Enstrangement on Estate Planning

Unfortunately, rifts sometimes arise between family members that are much more serious than just temporary squabbles. The result may be estrangement, defined as “the state of being alienated or separated in feeling or affection; a state of hostility or unfriendliness” or “the state of being separated or removed.” Estrangement does not mean that the relationship has come to an end legally, however.

Bills and Services to Cancel—and Keep—When a Loved One Dies

Bills and Services to Cancel—and Keep—When a Loved One Dies. Most people subscribe to multiple digital subscription services in addition to utilities, insurance, memberships, medical prescriptions, and other recurring payment programs. Settling these accounts helps avoid unnecessary charges and protect against identity theft and fraud. If the duty to handle outstanding accounts falls to you, you will first want to identify which accounts your loved one held and then figure out what to do with them.

Why You Want to Avoid Dying Without a Will in Place?

While the reasons for not having a will vary, the end result is the same for everyone: they do not get to choose who receives their property when they die. Instead, their money and property are distributed according to the laws of their state in a process called intestate succession.

Difference Between Transfer on Death and Payable on Death Designation

Adding a payable-on-death (POD) or transfer-on-death (TOD) designation to an account allows the assets (money and property) in that account to be passed to a named beneficiary when the original account holder dies.

Do I Lose Control of My Assets in a Living Trust?

What happens with my assets in a living trust?

Have an Etsy Store? Make Sure It Is Properly Protected

Etsy sellers tend to be independent workers who seek success on their own terms. But you should have a contingency plan for your Etsy store that considers the worst-case scenario of incapacitation or death. Ask yourself: what would happen to your store if you were no longer able to run it?

Gifting Personal Items in an Estate Plan

Gaps in an estate plan can lead to conflict among surviving family members. Estate plans tend to focus on big-ticket items like houses, cars, bank accounts, and investments. But deciding who is entitled to personal momentos – especially valuable ones-can be an underestimated source of contention.

When and How Will Your Child Receive Their Inheritance?

Do you know what happens to your child’s inheritance if you do or do not have an estate plan?

What Happens If I am Alive But Cannot Communicate?

Contemplating incapacity can be as anxiety-inducing as thinking about death. There are estate planning tools that can ensure that you do not end up in legal limbo due to a mental or physical disorder that renders you unable to manage your affairs or make decisions.

Planning a Barbecue Is Like Planning Your Estate

For many, Summer signals the beginning of summer and enjoying warm-weather activities, including backyard barbecues with friends and family. Although a cookout may be an informal affair, planning is crucial to its success. This is true for estate planning, too. Just as preparations are necessary for a successful cookout, a little planning goes a long way to prevent a poorly designed estate plan (or no estate plan at all!) from leaving you and your loved ones in a pickle.

Remodeling a Home in a Trust with a Home Equity Loan

If you want to remodel your home that is a trust with an equity loan, there are some things you should know.

Will I Have to Pay a Mortgage In Full if I Inherit a Property From a Relative?

The Garn–St Germain Act is a federal law that allows lenders to enter into or enforce contracts, including mortgage agreements, that contain due-on-sale clauses even if a state’s constitution or laws, including their judicial decisions, prohibit them.

What is a Limited Liability Company?

What is and LLC? What does it do?

How to Manage Expectations if You Should Win the Lottery?

How to manage expectations if you should win the lottery.

How to Donate Used Medical Equipment

How to Donate Used Medical Equipment. There are several options and locations that will accept this type of equipment.

Working with Co-trustees: How You Can Help

When clients select a successor trustee for their trust, they frequently choose one person to serve as a successor trustee at a time. However, many clients are reluctant to place the entire responsibility for trust administration on one person. As a result, it is increasingly common for a trustmaker to nominate two or more family members or friends to serve as successor co-trustees.

Ways Your Will Can Be Revoked

But simply creating a will does not mean that your estate plan is complete or final: your will may need to be updated from time to time. It may even need to be revoked and redrafted entirely.

Usually, revoking a will is a purposeful act on the part of the will maker. But many states have laws that automatically revoke a will, or portions of it, in specific situations.

Using a Standby Supplemental Needs Trust to Protect Your Loved Ones

As helpful as it would be when planning, no one has a crystal ball to see into the future. We do not know when we will pass away, and we do not know what position a beneficiary will be in at the time of our death. So even if you do not currently have a loved one who is disabled, it is critical not to overlook the question of what will happen if your loved one becomes disabled at a future time.

Have You Chosen the Right Trustee?

Whether you are reviewing your existing trust or creating a new trust, you should understand the important role that a trustee plays not only in handling trust matters but also in providing for and protecting your loved ones.

Have You Thought Through Your Retirement Plans?

Beginning your retirement is a great milestone that is worth celebrating. You have put in many years of hard work, and you are now able to focus your energy on the next phase of your life. However, before you begin this next chapter, you need to make sure that you have fully thought through this exciting change in your life. With this new chapter come certain estate planning issues that you need to consider.

Don’t Make These Common, Expensive Mistakes: How to Leave Assets to Minor Children

Most parents want to make sure their children are provided for in the event something happens to them while the children are still minors. Grandparents, aunts, uncles, and good friends sometimes want to leave gifts to beloved young children too. Unfortunately, good intentions and poor planning often have unintended results. Don’t make these common, expensive mistakes. Instead, here’s how to both protect and provide for the children you love.

How to Make Your Inheritance Last

About one-third of Americans who receive an inheritance have negative savings within two years of getting their money, and of those who receive $100,000 or more, nearly one in five spend, donate or simply lose it all. If you are about to receive an inheritance, there are several steps you can take to insure your funds will last longer than a few years.

Estate Planning Tips for Someone Who Is About to Go in for Major Surgery

Getting the news that you have to undergo major surgery is never easy. Preparing for absences from work, planning for childcare and household responsibilities, and reviewing your estate plan will be among the things you may be worrying about. But, what if you only have a few weeks—or even days—to react? Who should you call? How can you concentrate enough to get this work done? Make the best use of your time by considering the following tips.

What Is the Effect of an Unrecorded Deed?

A deed is a legal document used to transfer real property ownership rights from one person or entity (the grantor) to another (the grantee). Not recording a deed can cause problems for the grantee. They may be unable to obtain a mortgage, insure the property, or sell it. Even more problematic, an unrecorded deed may make it possible for the grantor to sell the property to a buyer and subsequently sell the same property to a different buyer. This could result in the property being sold out from under the original buyer who failed to record the deed.

Protecting Your Children’s Inheritance When You are Divorced

Sadly, loved ones of divorced people who do not make effective use of the estate planning tools are often left at the mercy of someone who may not be the best choice. Naming a beneficiary for retirement benefits or life insurance, or having a will can be a good start. However, the complexities of relationships, post-divorce, often render these basic tools inadequate. Luckily, there is a way to protect and control your children’s inheritance fully.

Why You May Still Have to Open a Legal Probate Proceeding

If someone dies without a will, probate is the process by which a court declares who that person’s heirs are and appoints an administrator who will distribute the person’s money and property as required by state law. Because the probate process can sometimes be expensive and lengthy, and the details of the deceased person’s estate may become part of public court records, many people create an estate plan designed to avoid probate by using a revocable living trust. However, there are some circumstances in which a probate proceeding may still be necessary.

Important Steps to Protect Your Special Beneficiaries

All children are a blessing. From the day they are born, you begin making plans to ensure that your child or grandchild has a bright future. What will their interests be? What job will they have? Who will they marry? While these are common concerns for most families, for those with a special needs child or grandchild, taking steps to ensure they have a safe, happy, and healthy future is even more important due to the additional hurdles they may face.

Which life events that require an immediate estate plan update?

Since your family’s needs and circumstances are constantly changing, so too must your estate plan. Your plan must be updated when certain life changes occur. These include, but are not limited to: marriage, the birth or adoption of a new family member, divorce, the death of a loved one, a significant change in assets, and a move to a new state or country.

The Perils of Joint Property

People often set up bank accounts or real estate so that they own it jointly with a spouse or other family member. The appeal of joint tenancy is that when one owner dies, the other will automatically inherit the property without it having to go through probate. That’s all well and good, but joint ownership can also cause unintended consequences and complications.

Isn’t There Already A Law That Leaves Everything To My Spouse And Kids?

Many people think that if they die while they are married, everything they own automatically goes to their spouse or children. They’re actually thinking of state rules that apply if someone dies without leaving a will. In legal jargon, this is referred to as “intestate.” In that case, the specifics will vary depending on each state’s law, so where you live when you die can significantly change the outcome for your family.

Important Milestones You Can Incorporate in Your Estate Plan

Life is full of contingencies. While some outcomes are relatively certain, other events are more difficult to predict. This uncertainty can create estate planning challenges. Because life changes quickly and sometimes unexpectedly, your estate plan needs to be flexible. Incorporating milestones into your estate plan is one way to hedge against the unpredictable future. By creating incentives for particular events, you can continue to exercise your values and provide for your loved ones beyond your lifetime.

Things You Can Do to Help Prove You Are Mentally Competent When Executing Your Estate Plan

In most states, there is a legal presumption that people have capacity to create their estate planning documents and that they can transfer their property to whomever they would like. This means that the person challenging your plan has the burden of proving that you did not have capacity at the time your documents were signed. Nevertheless, there are some proactive steps you can take to provide evidence that you were competent when you created or updated your estate plan.

Your Planning Team for Your Next Adventure

When planning your next great travel adventure, you may decide that you can do it yourself. You know what you and your travel companions want to see and do, how much you are willing to pay, and the most convenient times to travel. While making travel arrangements may be okay to do yourself, you need to consider calling in a special planning team to make sure that you and your loved ones are protected during your travels and afterward. The following are some individuals you should schedule appointments with before you leave on your next adventure.

Important Issues to Address Before You Leave on Vacation

Getting ready to embark on your next great adventure? Before you zip up the last suitcase, here are five issues you need to address to protect yourself and your loved ones.

What If I Cannot Find a Beneficiary?

When someone has named you as the executor (also known as a personal representative) of their will or the trustee of their trust passes away, you are obligated to distribute that person’s money and property according to the document’s terms to the designated beneficiaries. (For convenience, the roles of executor and trustee will be referred to throughout this article as the general term fiduciary.) Sometimes, perhaps because of a family conflict or just falling out of touch, the whereabouts of a will or trust beneficiary are unknown. What should you, as the fiduciary, do if you cannot locate a beneficiary of the will or trust?

An Introduction to Dynasty Trusts

When people create estate plans, they typically focus on handing down their money and property to their children, grandchildren, and other living heirs. But some people want to leave behind a more enduring legacy. For those interested in multigenerational wealth transfer, a dynasty trust could be the answer.

Why a Trust is the Best Option to Avoid Probate

There are numerous tools of the trade that a qualified attorney can use to keep your money and property out of probate, for example, establishing joint ownership on bank accounts and real estate titles, designating beneficiaries for life insurance policies and certain accounts, and so on. However, setting up a revocable living trust is quite often the best, most comprehensive option for avoiding probate. Let’s discuss why this is true.

Three Celebrity Probate Disasters and Tragic Lessons

One would assume that celebrities with extreme wealth would take steps to protect their estates. But think again: some of the world’s richest and most famous people enter the pearly gates with no estate plan, while others have made estate planning mistakes that tied up their fortunes and heirs in court for years. Let us look at three high-profile celebrity probate disasters and discover what lessons we can learn from them.

How is a corporate trustee different?

In its simplest terms, a trust is a legal arrangement in which a trustee holds and manages assets for the benefit of one or more beneficiaries. The trustee owns the assets, enters into contracts on behalf of the trust, manages the trust’s investments as its trustee, and follows the trust’s instructions on making distributions. A trustee can be one person, multiple people, or a company.

Three Reasons to Avoid Probate

Having a will is a good basic form of planning, a will does not avoid probate. Instead, a will simply lets you inform the probate court of your wishes—your loved ones still have to go through the probate process to make those wishes legal. Now that you have an idea of why probate might be necessary, here are three key reasons why you may want to avoid probate, if at all possible.

Things to Consider Before Accepting Your Inheritance

The news that you will be receiving an inheritance is often bittersweet because it means that somebody close to you has passed away. But you might also have mixed emotions about your inheritance for reasons that have to do with the actual accounts or property you are inheriting.

On the one hand, you might not want to reject your inheritance out of respect for the person who put you in their will or trust or named you as the beneficiary of an account or policy. On the other hand, depending on what you have been gifted, an inheritance might pose unintended logistical or financial difficulties that you are unable—or unwilling—to take on.

What to Do When Your Doctor Says to “Get Your Affairs in Order”

Five words no one ever wants to hear from their doctor: “Get your affairs in order.” Unfortunately, 58 percent of Americans do not have a will or trust, and it often requires a chronic disease or terminal illness diagnosis, or other life-changing event to prompt the estate planning process. Talk to your attorney about completing the documents below and follow these tips to protect your future and make the circumstances easier for your loved ones.

Questions You Should Ask Your Estate Planning Attorney

Creating an estate plan is a personal and often emotional undertaking, making the selection of your estate planning attorney of the utmost importance. Here are some questions you should ask your estate planning attorney to determine if they are the right person for the job.

Estate Planning Pop Quiz – Final Question – True or false? A will accomplishes all of the same goals as a trust, but a will is cheaper?

Final question of our Pop Quiz. September means school is back in session or just around the corner, signaling the return of new school supplies, homework, and pop quizzes. Try your hand at this estate planning pop quiz to see if your knowledge of estate planning makes the grade and if it is time for us to schedule a meeting.

Estate Planning Pop Quiz Question #2: True or false? If I do not create my own estate plan or if my plan fails to provide for my current situation, my state’s law will decide what happens.

Question 2 of our Estate Planning Pop Quiz. September means school is back in session or just around the corner, signaling the return of new school supplies, homework, and pop quizzes. Try your hand at this estate planning pop quiz to see if your knowledge of estate planning makes the grade and if it is time for us to schedule a meeting.

Estate Planning Pop Quiz – Question #1: True or False? You must name the same person to make both your financial and medical decisions on your behalf?

September means school is back in session or just around the corner, signaling the return of new school supplies, homework, and pop quizzes. Try your hand at this estate planning pop quiz to see if your knowledge of estate planning makes the grade and if it is time for us to schedule a meeting.

You Are Never Too Young for An Estate Plan

Estate planning is definitely not a one-size-fits-all kind of deal. Every family has unique dynamics and circumstances that must be considered and examined when preparing an estate plan. As our lives evolve, so too do our needs and goals, which means an estate plan...

Common Excuses for Women for Evading Estate Planning

I believe the biggest reason women don’t plan is lack of education about the importance of estate planning. It is not easy to learn or speak about the possibility that one may, at some point in time, lose their independence and ability to take care of themselves. It is even more difficult to discuss the certainty of death.

Although lack of education is a major factor for woman failing to plan, other factors have an influence on women as well.

Tell Me a Little About Trusts

Who are the parties in a trust and how does a trust work?

What’s Probate? Sounds Scary, and It Can Be.

Regardless of whether someone has a will, their family will have to go through probate. What is the purpose of probate?

When a Bad Estate Plan is Worse Than No Plan At All

A poorly-constructed estate plan can in some cases be worse than having no plan at all. Poorly-constructed estate plans commonly lead to overpayment of taxes (with money that would have been better spent by the surviving family members) and expensive, needless court processes and legal battles (again, money better spent by the surviving family members).

Informal Probate Can’t Be As Bad As Formal Probate, Right?

For those not familiar with the term, probate refers to the legal process required to distribute the assets of the deceased. During the probate process, a representative is authorized to pay debts and distribute assets on behalf of the deceased. In probate, there are different routes: informal probate or formal probate.

Revocable Trust vs. Irrevocable Trust: Which Is Best for You?

A properly funded trust allows you to avoid probate, minimize taxes, provides organization, maintains control, and provides for yourself and your heirs. In its most simple terms, a trust is a book of instructions wherein you tell your trusted people what to do, when. While there are many types of trusts, the major distinction between trusts is whether they are revocable or irrevocable. We will take a look at both so you will have the information you need.

What Happens to My Spouse’s Debts at Their Death?

A spouse’s death creates a difficult and demanding time for the surviving partner. As much as you might want space and time alone to process your grief, you may have certain responsibilities related to settling your deceased spouse’s affairs, including paying off their debt.

Important Questions to Ask When Investing in a Vacation Property

According to the National Association of Home Builders, in 2018 there were approximately 7.5 million second homes, making up 5.5 percent of the total number of homes. These homes are not only real estate that must be planned for, managed, and maintained, they are also the birthplace of happy memories for you and your loved ones. Following are some important estate planning questions to consider to ensure that your place of happy memories is protected.

Don’t Have a Lot of Money? Here Are Seven Ways You Can Still Leave Your Family a Great Legacy

Although the word “inheritance” usually conjures up images of property or accounts with significant monetary value, you can leave your family an even longer-lasting inheritance by doing these seven things, whether or not your bank account is overflowing.

Do You Update Your Estate Plan as Often as Your Resume?

A resume is a snapshot of your experience, skill set, and education that provides prospective employers insight into who you are and how you will perform. Imagine not updating your resume for five, ten, or even fifteen years. Would it accurately reflect your professional abilities? Would it do what you want it to do? Probably not. Estate plans are similar in that they need to be regularly updated to reflect changes in your life and the law so they can do what you want them to do. Outdated estate plans, like outdated resumes, simply do not work.

When Rock Legends Pass Away: The Possible Fates of Meat Loaf’s $40 Million Estate

Meat Loaf, whose real name was Michael Lee Aday, passed away earlier this year at the age of seventy-four. There is no questioning the legacy of one of rock and roll’s biggest icons. But there are still unanswered legal questions about the fate of Meat Loaf’s estate. Although there is no evidence to suggest that Meat Loaf died intestate (i.e., without a will), we can speculate about his estate plan based on his life, legacy, and available legal instruments.

Important Steps to Protect Your Special Beneficiaries

All children are a blessing. From the day they are born, you begin making plans to ensure that your child or grandchild has a bright future. What will their interests be? What job will they have? Who will they marry? While these are common concerns for most families, for those with a special needs child or grandchild, taking steps to ensure they have a safe, happy, and healthy future is even more important due to the additional hurdles they may face. Attorney Kelly Longtin discusses steps to help provide a prosperous future for your special needs child or grandchild.

Three Steps to Take When the Deceased Has Controlled Substances

There are so many things to think about when a loved one passes away. What to do with the prescription drugs (or other controlled substances) that are in your loved one’s medicine cabinet is not usually at the top of that list. Yet, to avoid running afoul of laws governing their disposal, it is important to understand the proper procedures for disposing of a deceased person’s controlled substances.

If I Give My Home to My Child In My Will, Can They Take My Home While I Am Still Alive?

If I Give My Home to My Child in My Will, Can They Take My Home While I Am Still Alive? The short answer to this question is no. Naming your child as the recipient of your home in your will does not give them any right to your home while you are still living. However, understanding why that is the correct answer requires a little more explanation.

Important Things Your Agent Under a Medical Power of Attorney Needs to Know

A medical power of attorney is a crucial part of your estate plan that enables you to name a trusted person to make healthcare decisions for you if needed. It is essential for the person you name to have the information necessary to carry out your wishes for your medical care.

When a Gift May Not Be a Gift

Estate Planning – When a gift may not be a gift. The federal tax code has very specific rules about how much you are allowed to transfer to others each year—and over the course of your lifetime—in the form of a gift. Any gifts above that amount may be subject to gift tax, which is paid by the giver. However, not every gift is subject to gift tax. There are annual exclusion amounts, a lifetime exemption amount, and other exclusions.

Estate Planning Considerations for Couples with an Age Gap

With couples of similar ages, planning for the future is naturally a joint effort. However, if you are married to someone who is significantly older or younger than you, the future can look different and mean different things to each of you. To protect yourself, your spouse, and other loved ones, you need to have comprehensive financial and estate plans. For these plans to work as intended, it is important that you have an open and honest conversation with your spouse about the following financial and estate planning topics.

Electronic Wills

What is an Electronic Will? Will the courts determine if a will created and stored on a computer meets the requirements? What States Allow Electronic Wills? Should you use an Electronic Will?

How to Protect Yourself from Claims of Self-Dealing When Serving as a Trustee

A trustee usually has quite a bit of discretion in their management of a trust’s accounts, money, and property (known as assets). At the same time, as a fiduciary, a trustee also owes the trust’s beneficiaries a duty of loyalty, which prohibits the trustee from self-dealing. In the simplest terms, self-dealing happens when a trustee uses the trust’s assets for their own benefit instead of for the beneficiaries’ benefit.

Can I Make Estate Plans Without My Spouse?

The assumption that a couple will share finances, tax obligations, and a last name is one that does not necessarily apply in the 21st century. There are more options than ever before to keep your finances, identity, and future plans separate. This sense of independence leads many married people to question: can I make estate planning decisions without involving my spouse? The answer can be more complicated than you might expect.

Unclaimed Property – What is it, Where to find it, and its Impact on Estate Planning and Administration.

Regardless of how careful we are with our finances, it is possible for utility deposits, credit balances, unused gift certificates, banks accounts, and many more types of property or money to accidentally be forgotten or abandoned. In fact, across the country, there are billions of dollars in unclaimed property being held by the state and federal government. Fortunately, it is often possible to locate this property and obtain it. It is equally important for estate administrators or family members to look for unclaimed property when a loved one dies to be sure that all of his or her property is included in the estate and goes to the intended beneficiaries.

Happy 18th Birthday! Now What?

Congratulations! You are now considered a legal adult. Aside from purchasing alcohol, there is now very little you cannot legally do. Even though you may not feel any different, from a legal standpoint, a lot has changed. When you were a minor (under the age of 18),...

Changes to the FAFSA Form and What It Means for Grandparents

For grandparents who want to leave a legacy to their grandchildren, the gift of a 529 college savings plan is an option. Not only can opening a 529 plan account help a grandchild with educational expenses, it can also help grandparents with their estate planning goals.

In the past, grandparent 529 plans had the potential to reduce student aid eligibility. However, changes to student aid application rules mean that soon, 529 distributions from grandparents will not count toward a student’s income on the most-used financial aid form. This is welcome news for grandparents who want to help cover the ever-increasing costs of higher education without impacting a student’s need-based financial aid eligibility.

Estate Planning for Rental Property Owners

If you have a home or other rental property that is generating income, you should understand the following asset protection and estate planning considerations.

Avoiding Financial Grief: How to Protect Your Significant Other from Frozen Accounts

The death of a loved one is one of the most difficult times in a person’s life. Nothing can truly prepare a person for such a loss. However, dealing with the financial stress of frozen bank accounts can exacerbate the stress. Without proper planning, your significant other could struggle to gain access to your accounts.

Pour-Over Will: Not Your Average Will

Wills and trusts are the two basic legal instruments that people use to pass accounts and property on to their loved ones at death. Although a revocable living trust is often used in place of a will, the two are not mutually exclusive. You can have both a will and a...

Using Real Estate Deeds in Estate Planning

When using trusts in estate planning, a key element includes transferring the trustmaker’s real estate into the trust by recording a deed with the local recording authority. This step is crucial for ensuring that the trustee has the authority to manage and ultimately...

Deeper Dive Into Advance Healthcare Directives

When it comes to your healthcare, especially during these uncertain times, you need to ensure that two estate planning documents in particular are up to date. The first is your healthcare power of attorney. This document allows you to name a person to make medical...

What Happens to Your Social Media Accounts at Your Death?

According to Statista, more than 295 million people in the United States use social media.[1] If you are an avid social media user, have you considered what will happen to your accounts when you die? If you have spent time creating, uploading, and sharing content, it...

Writing Your Own Obituary as an Addition to Your Estate Plan

An obituary can be much more than just a dry announcement of the time and location of your funeral or memorial service. It can be a way to share your life story, communicating information about significant events and people, as well as important values you would like...

Slayer Statutes: Preventing Killers from Profiting from Their Crimes

Most states have laws that prevent someone who has intentionally killed another individual from being able to inherit any property from their victim.[1] In general, these laws are referred to as “slayer statutes” and are designed to prevent the patently unjust outcome...

Untangling Tangled Titles: Homeownership, Property Deeds, and Estate Planning

Do you really own the home you live in? If you are currently living in a property that you inherited but the deed has not been transferred into your name, you may be surprised to learn that, under the law, you are technically not the owner. This legal situation is...